Making Dispute Resolution More Effective – MAP Peer Review Report, Chile (Stage 2): Inclusive Framework on BEPS: Action 14 (OECD/G20 Base Erosion and Profit Shifting Project): Organisation for Economic Co-operation and Development:

PDF) OECD/G20 base Erosion and Profit shifting Project Guidance on Transfer Pricing Documentation and Country-by-Country Reporting | Babehgelo Basecamp - Academia.edu

What Do We Know About Base Erosion and Profit Shifting? A Review of the Empirical Literature | Publications | CESifo

OECD/G20 Base Erosion and Profit Shifting Project - Addressing the Tax Challenges of the Digital Economy

Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting - Wikipedia

PDF) www.pwc.com/taxpolicy Tax Policy Bulletin OECD's Action Plan published on Base Erosion and Profit Shifting (BEPS | avital shapira - Academia.edu

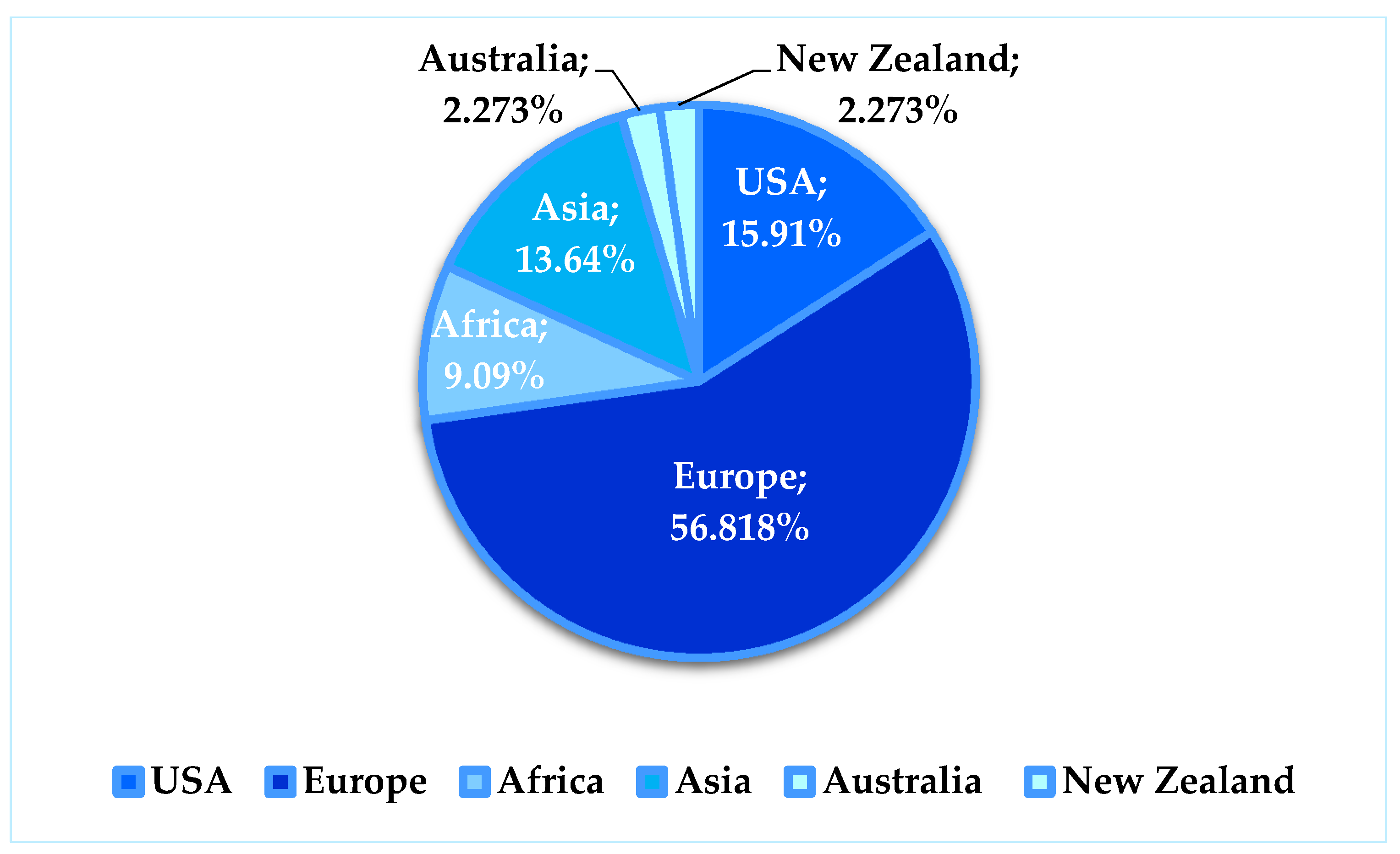

Sustainability | Free Full-Text | Sustainability Assessment: Does the OECD/G20 Inclusive Framework for BEPS (Base Erosion and Profit Shifting Project) Put an End to Disputes Over The Recognition and Measurement of Intellectual

How Large is the Corporate Tax Base Erosion and Profit Shifting? A General Equlibrium Approach | Publications | CESifo

PDF) OECD Action Plan in Base Erosion and Profit Shifting in Taxation and the Situation of Turkey | elvan cenikli - Academia.edu

PDF) Transfer pricing documentation – an efficient measure for combating the base erosion and profit shifting?

Limiting Base Erosion Involving Interest Deductions and Other Financial Payments, Action 4 - 2015 Final Report | READ online

OECD/G20 Base Erosion and Profit Shifting Project Tax Challenges Arising from Digitalisation – Economic Impact Assessment Inclusive Framework on BEPS: OECD: 9789264495074: Amazon.com: Books

Base Erosion and Profit Shifting: How Corporations Use Transfer Pricing to Avoid Taxation - LIRA@BC Law

How large is the corporate tax base erosion and profit shifting? A general equilibrium approach: Economic Systems Research: Vol 34, No 2